Legislative Scorecard

2023

31 March 2023

Please take just a moment to send an email to your representative about HB915 which would amend the Montana Constitution to give the Governor power to appoint Supreme Court Justices. The following link will take you to a Northern Plains webpage where you can send an email to your representative by putting in your address and they’ll connect you to your representative and provide a short email which you can amend if you wish to.

https://northernplains.org/campaign/tell-your-representative-to-vote-no-on-hb-915/#/23/

Thanks for helping to protect the Montana Constitution!

Please take just a moment to send an email to your representative about HB915 which would amend the Montana Constitution to give the Governor power to appoint Supreme Court Justices. The following link will take you to a Northern Plains webpage where you can send an email to your representative by putting in your address and they’ll connect you to your representative and provide a short email which you can amend if you wish to.

https://northernplains.org/campaign/tell-your-representative-to-vote-no-on-hb-915/#/23/

Thanks for helping to protect the Montana Constitution!

27 March 2023

If you have a chance, please take a moment to contact your representatives before March 28th and urge them to vote NO on SB524. You can read the bill at the following link: https://leg.mt.gov/bills/2023/billpdf/SB0524.pdf

Emily Auld with Northern Plaines Resource Council wrote up the talking points below if you have a chance to call Senator Emrich (406) 781-3955 or email [email protected]

Montana Legislature: https://www.leg.mt.gov/

Find Bills: http://laws.leg.mt.gov/legprd/law0203w$.startup?P_SESS=20231

Thanks,

Kathy Gessaman

CCE Secretary

SB 524 Talking Points:

SB 524, sponsored by Sen. Greg Hertz (R, Polson) would target the work of organizations like Northern Plains and require that organizations like ours declare any expenses related to challenging or supporting government’s actions as non-charitable expenditures. The language of this bill is incredibly broad and would impact Northern Plains work on nearly every front. This bill seeks to intimidate organizations like Northern Plains from engaging in our important work to give every day Montanan’s a say over the decisions that impact their lives by making the cost of doing that work more expensive.

Key points:

• SB 524 is a slippery slope. While the bill targets expenses related to the challenge or support of government actions related to clean air, water, resource extraction and development, it also includes and challenge or support of actions related to agriculture, livestock, and land use, and it sets a precedent to target the work of any organization that a legislator decides they dislike.

• This bill attacks one of the core purposes of nonprofits: to interact with our government agencies to address and meet the needs of our communities. This bill seeks to use financial intimidation to prevent people associated with non-profits from engaging in the development and implementation of policies and to engage in processes created by the government to solicit feedback and input on policies and initiatives. This bill will prohibit critical progress and create more inefficiencies in our system.

• This bill takes away any balance of power between citizens and private companies and disallows any ability to work together and stand up for ourselves. It is throwing roadblocks and expense onto everyday people organizing to protect their families, livelihoods, and communities.

• This bill will undoubtedly be challenged in court which is an unnecessary taxpayer expense and waste of valuable state employee time.

If you have a chance, please take a moment to contact your representatives before March 28th and urge them to vote NO on SB524. You can read the bill at the following link: https://leg.mt.gov/bills/2023/billpdf/SB0524.pdf

Emily Auld with Northern Plaines Resource Council wrote up the talking points below if you have a chance to call Senator Emrich (406) 781-3955 or email [email protected]

Montana Legislature: https://www.leg.mt.gov/

Find Bills: http://laws.leg.mt.gov/legprd/law0203w$.startup?P_SESS=20231

Thanks,

Kathy Gessaman

CCE Secretary

SB 524 Talking Points:

SB 524, sponsored by Sen. Greg Hertz (R, Polson) would target the work of organizations like Northern Plains and require that organizations like ours declare any expenses related to challenging or supporting government’s actions as non-charitable expenditures. The language of this bill is incredibly broad and would impact Northern Plains work on nearly every front. This bill seeks to intimidate organizations like Northern Plains from engaging in our important work to give every day Montanan’s a say over the decisions that impact their lives by making the cost of doing that work more expensive.

Key points:

• SB 524 is a slippery slope. While the bill targets expenses related to the challenge or support of government actions related to clean air, water, resource extraction and development, it also includes and challenge or support of actions related to agriculture, livestock, and land use, and it sets a precedent to target the work of any organization that a legislator decides they dislike.

• This bill attacks one of the core purposes of nonprofits: to interact with our government agencies to address and meet the needs of our communities. This bill seeks to use financial intimidation to prevent people associated with non-profits from engaging in the development and implementation of policies and to engage in processes created by the government to solicit feedback and input on policies and initiatives. This bill will prohibit critical progress and create more inefficiencies in our system.

• This bill takes away any balance of power between citizens and private companies and disallows any ability to work together and stand up for ourselves. It is throwing roadblocks and expense onto everyday people organizing to protect their families, livelihoods, and communities.

• This bill will undoubtedly be challenged in court which is an unnecessary taxpayer expense and waste of valuable state employee time.

22 March 2023

If you have a moment, please use the sample letter below to compose an email to send to the Governor’s Office: https://governor.mt.gov/Contact/ and to the Montana DEQ: https://www.deq.mt.gov/about/ContactUs

Thanks for any help you can give to help Montana preserve its $3 Million share of the $4.6 Billion EPA allocation noted in the email from Steve Thompson below. The DEQ is in contact with the Governor’s office and is looking for public comment .

Deadline for Montana to submit a Notice of Intent to Participate is March 31st.

Kathy Gessaman

CCE Secretary

Example of a sample letter:

Subject line: Climate Pollution Reduction Grant Deadline March 31

March __, 2023

<Recipient Title and Address>

Dear <Title and Name>:

I'm <name>, and am [a member or title] of <organization name>. I'm writing to encourage the State of Montana to participate in an important federal grant opportunity. Time is short - each state must submit its Notice of Intent to Participate (NOIP) by March 31. The program is EPA's Climate Pollution Reduction Grants (CPRG), which "supports the development and deployment of technologies and solutions that will reduce greenhouse gasses and harmful air pollution, as well as transition America to a clean energy economy that benefits all Americans."

These initial grants are for $3M per state, they're noncompetitive (guaranteed), and are important because they will prepare each state to compete or be competitive for subsequent competitive grants, such as these:

● $4.6B: Climate Pollution Reduction Implementation Grants

● $27B: Greenhouse Gas Reduction Fund

● $3B: Environmental and Climate Justice Block Grants

● $3.2B: Neighborhood Access and Equity Grant Program

● $1B: Clean Heavy-Duty Vehicles (Class 6&7)

These planning grants support each state working with other levels of government within its borders to develop plans to reduce climate pollution. EPA has held several preparatory webinars (recordings and slides available here), and on March 1, 2023 issued CPRG program guidance which includes a helpful overview.

I encourage the state to submit a Notice of Intent to Participate before the March 31, 2023 deadline for the noncompetitive planning grants, followed by applications and work plans a month later on April 28, 2023. Notices of funding opportunity are expected later in 2023, with applications for the $4.6B in competitive grants due in 2024Q1.

If you have a moment, please use the sample letter below to compose an email to send to the Governor’s Office: https://governor.mt.gov/Contact/ and to the Montana DEQ: https://www.deq.mt.gov/about/ContactUs

Thanks for any help you can give to help Montana preserve its $3 Million share of the $4.6 Billion EPA allocation noted in the email from Steve Thompson below. The DEQ is in contact with the Governor’s office and is looking for public comment .

Deadline for Montana to submit a Notice of Intent to Participate is March 31st.

Kathy Gessaman

CCE Secretary

Example of a sample letter:

Subject line: Climate Pollution Reduction Grant Deadline March 31

March __, 2023

<Recipient Title and Address>

Dear <Title and Name>:

I'm <name>, and am [a member or title] of <organization name>. I'm writing to encourage the State of Montana to participate in an important federal grant opportunity. Time is short - each state must submit its Notice of Intent to Participate (NOIP) by March 31. The program is EPA's Climate Pollution Reduction Grants (CPRG), which "supports the development and deployment of technologies and solutions that will reduce greenhouse gasses and harmful air pollution, as well as transition America to a clean energy economy that benefits all Americans."

These initial grants are for $3M per state, they're noncompetitive (guaranteed), and are important because they will prepare each state to compete or be competitive for subsequent competitive grants, such as these:

● $4.6B: Climate Pollution Reduction Implementation Grants

● $27B: Greenhouse Gas Reduction Fund

● $3B: Environmental and Climate Justice Block Grants

● $3.2B: Neighborhood Access and Equity Grant Program

● $1B: Clean Heavy-Duty Vehicles (Class 6&7)

These planning grants support each state working with other levels of government within its borders to develop plans to reduce climate pollution. EPA has held several preparatory webinars (recordings and slides available here), and on March 1, 2023 issued CPRG program guidance which includes a helpful overview.

I encourage the state to submit a Notice of Intent to Participate before the March 31, 2023 deadline for the noncompetitive planning grants, followed by applications and work plans a month later on April 28, 2023. Notices of funding opportunity are expected later in 2023, with applications for the $4.6B in competitive grants due in 2024Q1.

27 February 2023

It’s that time again when the legislature tries to do an end run around our ‘Clean and Healthy’ environment in Montana. Please take a moment and send a comment to your Representative.

Northern Plains resource council made it easy to send a comment to your legislature - you only need to input your address & zip.

https://northernplains.org/bill-tracker/#/14

It’s that time again when the legislature tries to do an end run around our ‘Clean and Healthy’ environment in Montana. Please take a moment and send a comment to your Representative.

Northern Plains resource council made it easy to send a comment to your legislature - you only need to input your address & zip.

https://northernplains.org/bill-tracker/#/14

2021

12 April 2021

Several bills are coming up for a vote that we should oppose. Visit MEIC's Legislature Bill Tracker page for more information.

Several bills are coming up for a vote that we should oppose. Visit MEIC's Legislature Bill Tracker page for more information.

23 March 2021 - HB 646 - More information

INFORMATION ON THE PATH FORWARD FOR THE HB 646 PART OF I-187

==========

March 22, 2021

Hello Kathy & Ron and all the MTCARES activists and supporters:

Here is the additional information promised now that the legislation taken from I-187 and its predecessors is being introduced. URL links have been disabled to make it through spam filters. You can copy, modify & paste the links to your browser.

Press Release

Contact: Tom Towe, 406-690-6656

Russ Doty, 406-696-2842

HEARING FOR HB 646 TO REPLACE DIMINISHING COAL REVENUE, ASSIST COAL-IMPACTED WORKERS & COMMUNITIES

HB 646 sponsored by Helena Rep. Mary Ann Dunwell was assigned to the House Taxation Committee for 8 AM hearing Thursday, March 25th. It replaces lost coal revenue while assisting communities disadvantaged by the market transition to cleaner, cheaper renewable power. And it is all paid for by an offsetting reduction in energy prices.

Before sunsetting, the worker-protection part of the HB 646 tax will provide about $955 million available over two decades to finance a pension safety net, up to two years of retraining, enhanced unemployment, and other help for Montana’s 2,109 coal industry workers and 5,100 others in coal-impacted communities.

HB 646 also will gradually replace lost revenue now coming to state, tribal, county, and city governments from coal royalties, leases, and coal taxes—about $1.049 billion total by 2034 and $139 million per year thereafter. Together the combined programs will receive $2.004 billion by 2034.

“Consumers should not notice much of the tax rate increase in an existing tax on each kilowatt hour of electricity to fund these measures,” noted Rep. Dunwell, “because $1.049 billion of that $2.004 billion in revenue will gradually replace the dwindling coal tax. I am excited to be seeking bi-partisan support for this forward-looking legislation embraced by Tom Towe, the former chair of the State Senate Taxation Committee from Billings who authored the Constitutional Coal Trust.”

“HB 646 is needed to replace dwindling coal revenue to continue funding the Constitutional Coal Trust, schools, county governments, Coal Board impact grants, the state long-range building program, the state parks trust, libraries, conservation districts, the cultural and aesthetics trust, and more,” Towe explained. “An energy replacement tax will be better than using other taxes to replicate lost coal revenue. Fortunately, it will be paid for out of the reduced cost of electricity and, thus, it does not increase the burden on electricity rate payers,” Towe said.

Energy from renewable sources does not have fuel or pollution control cost embedded in its pricing. So, the average household should save $7 to $15 per month as the market moves to cheaper renewable electricity. Thus, the entire combined $2.004 billion will be paid for by the current drop in energy prices.

The total HB 646 tax will be phased in starting at about $2.05 a month in 2021 for the average electricity consumer. It will climb to $5.72 per month by 2034. Then it drops to $3.84 per month thereafter in 2035. That 2035 amount equals ½ penny/kWh.

“The 2035 amount reflects the sunsetting of 1/4th of a penny on every kilowatt hour of electricity produced. Until 2034, 1/4th of a penny of the tax was for worker benefits and up to ½ of a penny was for projected gradual coal replacement tax collections,” added Greeley Colorado resident Russ Doty, former member of the Montana House Ways and Means (Taxation) Committee. As the main drafter of HB 646, Doty says it is appropriate for that 1/4th of a penny part of the HB tax “to aid workers who must shift jobs as markets end coal use.”

“Using ¼ of a penny to assist workers and coal-impacted communities will add only $1.88/month from savings to an average users’ light bill,” Rep Dunwell continued. “And since current market-driven saving from the wind and sun will always exceed the tax on poor and rich alike, more religious leaders are blessing the idea of using some savings to help our fellow Montanans.”

To support HB 646 please encourage legislators from each party to become bi-partisan cosponsors.

Track HB 646 hearing progress or contact legislators through the “Look Up Bills” link at the Legislature’s website leg.mt.gov.

Further Explanation of HB 646 is at the mtcares.org website.

Contact info: You may politely email a legislator or a full committee supporting HB 607 at leg.mt.gov/web-messaging . Don’t forget to enter the bill # (HB 646) select “for,” a legislator or committee and click “send message” when you are done. Please highlight and send us a copy of your email at admin(at)mtcares.org

You may also leave a polite phone message of support at (406) 444-4800--your message will be delivered to a legislator.

To testify or watch legislative hearings search “Have Your Say Montana” and follow the links. You must register by NOON Wednesday, March 24 (the day before testimony) to testify online. You may not be allowed to speak for more than 2 minutes so edit your comments accordingly. Please alert us with your testimony at admin(at)mtcares.org

Please show your support for this in every polite way you can. Feel free to contact me/us if you have questions or would like to coordinate action on this further. Thank you.

Dodie Andersen, MTCARES Team, (406)493-0606

Rev. Su DeBree, MTCARES Team

Russ Doty, MTCARES Team (406)696-2842

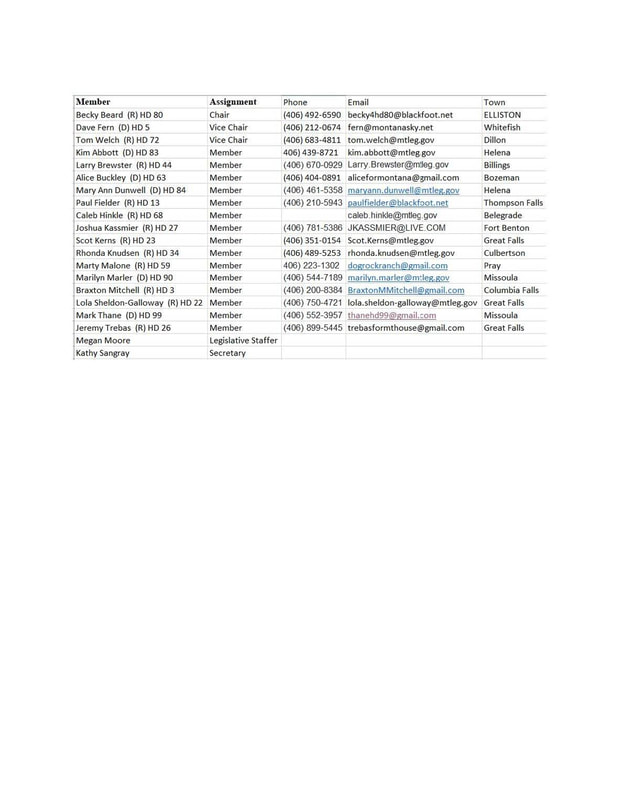

Members of the House Tax Committee are:

INFORMATION ON THE PATH FORWARD FOR THE HB 646 PART OF I-187

==========

March 22, 2021

Hello Kathy & Ron and all the MTCARES activists and supporters:

Here is the additional information promised now that the legislation taken from I-187 and its predecessors is being introduced. URL links have been disabled to make it through spam filters. You can copy, modify & paste the links to your browser.

Press Release

Contact: Tom Towe, 406-690-6656

Russ Doty, 406-696-2842

HEARING FOR HB 646 TO REPLACE DIMINISHING COAL REVENUE, ASSIST COAL-IMPACTED WORKERS & COMMUNITIES

HB 646 sponsored by Helena Rep. Mary Ann Dunwell was assigned to the House Taxation Committee for 8 AM hearing Thursday, March 25th. It replaces lost coal revenue while assisting communities disadvantaged by the market transition to cleaner, cheaper renewable power. And it is all paid for by an offsetting reduction in energy prices.

Before sunsetting, the worker-protection part of the HB 646 tax will provide about $955 million available over two decades to finance a pension safety net, up to two years of retraining, enhanced unemployment, and other help for Montana’s 2,109 coal industry workers and 5,100 others in coal-impacted communities.

HB 646 also will gradually replace lost revenue now coming to state, tribal, county, and city governments from coal royalties, leases, and coal taxes—about $1.049 billion total by 2034 and $139 million per year thereafter. Together the combined programs will receive $2.004 billion by 2034.

“Consumers should not notice much of the tax rate increase in an existing tax on each kilowatt hour of electricity to fund these measures,” noted Rep. Dunwell, “because $1.049 billion of that $2.004 billion in revenue will gradually replace the dwindling coal tax. I am excited to be seeking bi-partisan support for this forward-looking legislation embraced by Tom Towe, the former chair of the State Senate Taxation Committee from Billings who authored the Constitutional Coal Trust.”

“HB 646 is needed to replace dwindling coal revenue to continue funding the Constitutional Coal Trust, schools, county governments, Coal Board impact grants, the state long-range building program, the state parks trust, libraries, conservation districts, the cultural and aesthetics trust, and more,” Towe explained. “An energy replacement tax will be better than using other taxes to replicate lost coal revenue. Fortunately, it will be paid for out of the reduced cost of electricity and, thus, it does not increase the burden on electricity rate payers,” Towe said.

Energy from renewable sources does not have fuel or pollution control cost embedded in its pricing. So, the average household should save $7 to $15 per month as the market moves to cheaper renewable electricity. Thus, the entire combined $2.004 billion will be paid for by the current drop in energy prices.

The total HB 646 tax will be phased in starting at about $2.05 a month in 2021 for the average electricity consumer. It will climb to $5.72 per month by 2034. Then it drops to $3.84 per month thereafter in 2035. That 2035 amount equals ½ penny/kWh.

“The 2035 amount reflects the sunsetting of 1/4th of a penny on every kilowatt hour of electricity produced. Until 2034, 1/4th of a penny of the tax was for worker benefits and up to ½ of a penny was for projected gradual coal replacement tax collections,” added Greeley Colorado resident Russ Doty, former member of the Montana House Ways and Means (Taxation) Committee. As the main drafter of HB 646, Doty says it is appropriate for that 1/4th of a penny part of the HB tax “to aid workers who must shift jobs as markets end coal use.”

“Using ¼ of a penny to assist workers and coal-impacted communities will add only $1.88/month from savings to an average users’ light bill,” Rep Dunwell continued. “And since current market-driven saving from the wind and sun will always exceed the tax on poor and rich alike, more religious leaders are blessing the idea of using some savings to help our fellow Montanans.”

To support HB 646 please encourage legislators from each party to become bi-partisan cosponsors.

Track HB 646 hearing progress or contact legislators through the “Look Up Bills” link at the Legislature’s website leg.mt.gov.

Further Explanation of HB 646 is at the mtcares.org website.

Contact info: You may politely email a legislator or a full committee supporting HB 607 at leg.mt.gov/web-messaging . Don’t forget to enter the bill # (HB 646) select “for,” a legislator or committee and click “send message” when you are done. Please highlight and send us a copy of your email at admin(at)mtcares.org

You may also leave a polite phone message of support at (406) 444-4800--your message will be delivered to a legislator.

To testify or watch legislative hearings search “Have Your Say Montana” and follow the links. You must register by NOON Wednesday, March 24 (the day before testimony) to testify online. You may not be allowed to speak for more than 2 minutes so edit your comments accordingly. Please alert us with your testimony at admin(at)mtcares.org

Please show your support for this in every polite way you can. Feel free to contact me/us if you have questions or would like to coordinate action on this further. Thank you.

Dodie Andersen, MTCARES Team, (406)493-0606

Rev. Su DeBree, MTCARES Team

Russ Doty, MTCARES Team (406)696-2842

Members of the House Tax Committee are:

22 March 2021 - OPPOSE SB379

The 'Colstrip Welfare Bill' that stiffs us ratepayers

Please share and oppose SB379, which is going to the Senate Energy Committee very soon. Visit our blog for more information.

The 'Colstrip Welfare Bill' that stiffs us ratepayers

Please share and oppose SB379, which is going to the Senate Energy Committee very soon. Visit our blog for more information.

24 February 2021 - OPPOSE HB542

This bill will prohibit the use of state funds and other assistance to support nonprofit and for-profit radio stations. Visit our blog for more information.

18 February 2021 - MEIC Weekly Legislative Updates

Join MEIC via Zoom every Thursday from 5:00 - 5:30 p.m. for legislative updates relating to clean air, clean waterbvand a healthy climate.

Join MEIC via Zoom every Thursday from 5:00 - 5:30 p.m. for legislative updates relating to clean air, clean waterbvand a healthy climate.

12 February 2021 - From Rich Liebert, CCE Chairman

1. Let's please SHARE WIDELY to OPPOSE HB359 (a NW Energy industry bill) proposed by Rep. Larry Brewster, Retired NW Energy employee out of Billings. Surprised?

This Bill is out to CRIPPLE net-metering and Clean Energy Jobs for emerging small businesses that will bring on the REAL jobs for the 21st Century, NOT the dying fossil fuel industry that's always cutting out human labor at every turn for corporate profit - period.

Let's share with all of CCE, GF Rising, climate groups and COUNTER-ATTACK hard on this, and yet another net-metering bill that 'roars' out every session.

2. PLEASE CALL 444-4800, and OPPOSE HB359 and send to the House FRET (energy) Committee and your additional choice of up to five legislators. You might also want to contact the PSC and put this in their lap also, 444-6199.

Rich Liebert, Chair, CCE, ccemontana.org

PS - this bill could seriously diminish the PSC's role in watching over the energy industry and leaves it in the hands of utility monopolies, are we surprised?

1. Let's please SHARE WIDELY to OPPOSE HB359 (a NW Energy industry bill) proposed by Rep. Larry Brewster, Retired NW Energy employee out of Billings. Surprised?

This Bill is out to CRIPPLE net-metering and Clean Energy Jobs for emerging small businesses that will bring on the REAL jobs for the 21st Century, NOT the dying fossil fuel industry that's always cutting out human labor at every turn for corporate profit - period.

Let's share with all of CCE, GF Rising, climate groups and COUNTER-ATTACK hard on this, and yet another net-metering bill that 'roars' out every session.

2. PLEASE CALL 444-4800, and OPPOSE HB359 and send to the House FRET (energy) Committee and your additional choice of up to five legislators. You might also want to contact the PSC and put this in their lap also, 444-6199.

Rich Liebert, Chair, CCE, ccemontana.org

PS - this bill could seriously diminish the PSC's role in watching over the energy industry and leaves it in the hands of utility monopolies, are we surprised?

Check out Montana Legislature's Homepage https://leg.mt.gov/ where you can find more information on remote participation in the legislature, Bill Search, Legislator Search, Session Information, and Revenue and Budget Information, and where to click to Watch/Listen to all meetings. Call (406) 444-4800 for more information.

To keep up-to-date with how the Montana House and Senate vote on environmental legislation, click here.